Introduction:

When it comes to securing your family’s financial future, term life insurance is a popular and affordable choice. However, with a variety of options available, comparing its rate can feel overwhelming. In this guide, we’ll break down what term life insurance is, the factors affecting rates, and how to effectively compare policies to find the best coverage for your needs.

What is Term Life Insurance?

Term life insurance provides coverage for a specified period—usually 10, 20, or 30 years. If the insured individual passes away during the term, the beneficiaries receive a death benefit. If the term expires and the policyholder is still alive, the coverage ends, and no payout is made. This type of insurance is often more affordable than whole life insurance, making it an attractive option for many.

Factors Influencing Term Life Insurance Rates

Several factors can influence the rates of term life insurance, including:

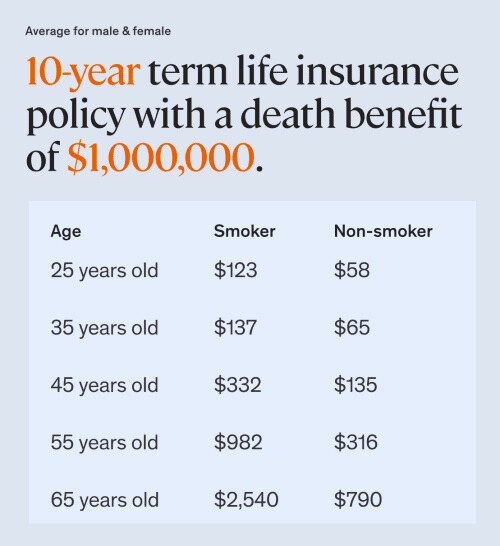

1. Age

Younger individuals typically pay lower premiums. As you age, the risk of health issues increases, leading to higher rates.

2. Health Status

Your current health, medical history, and lifestyle choices (like smoking or drinking) play a significant role in determining your rates. Underwriters assess these factors through medical exams and questionnaires.

3. Coverage Amount

The higher the death benefit you choose, the higher your premium will be. It’s essential to balance the coverage amount with what your beneficiaries might need.

4. Term Length

Longer-term policies usually come with higher premiums. Short-term policies, on the other hand, are generally more affordable.

5. Gender

Statistically, women tend to live longer than men, which can result in lower premiums for female policyholders.

How to Compare Term Life Insurance Rates

Comparing term life insurance rates is essential to ensure you’re getting the best deal. Here are some steps to follow:

1. Gather Quotes

Start by gathering quotes from multiple insurance providers. Many companies offer online calculators to give you an estimate based on your age, health, and desired coverage.

2. Consider the Policy Features

Look beyond just the premium. Some policies may include additional features, such as:

- Conversion Options: The ability to convert your term policy into a permanent one.

- Riders: Additional benefits that can be added to your policy, like critical illness or disability riders.

3. Review Financial Ratings

Research the insurance company’s financial stability. Agencies like A.M. Best and Standard & Poor’s provide ratings that can help you choose a reliable insurer.

4. Read Customer Reviews

Customer feedback can give insight into an insurer’s customer service and claims process. Look for reviews on independent websites for unbiased opinions.

5. Consult with an Agent

If you’re feeling overwhelmed, consider speaking with an insurance agent. They can provide personalized advice and help you understand the nuances of different policies.

Tips for Finding the Best Term Life Insurance Rates

- Shop Around: Rates can vary significantly between insurers. Taking the time to compare can save you money.

- Consider Your Needs: Assess your financial situation and the needs of your beneficiaries to determine the appropriate coverage amount.

- Review Regularly: As your life circumstances change (e.g., marriage, children, career changes), revisit your policy to ensure it still meets your needs.

Conclusion

Term life insurance is a valuable tool for protecting your family’s financial future. By understanding the factors that influence rates and following a thorough comparison process, you can find a policy that fits your needs and budget. Remember to review your options regularly to ensure you always have the best coverage in place.

Ready to get started? Use online quote tools today and take the first step towards securing peace of mind for you and your loved ones!