Introduction:

Dental health is an essential component of overall well-being, yet many people overlook the importance of having a good dental insurance plan. With various options available, it can be challenging to find the right one for your needs. In this guide, we will compare different dental insurance plans to help you make an informed decision.

Why Dental Insurance Matters

Dental insurance helps cover the costs of preventive care, treatments, and emergencies. With regular dental visits, you can catch issues early, preventing more extensive and costly procedures down the line. Investing in dental insurance is not just about coverage; it’s about safeguarding your health.

Types of Dental Insurance Plans

Preferred Provider Organization (PPO) Plans

Overview: PPO plans offer flexibility in choosing dental providers. You can see any dentist, but you’ll save more by visiting in-network providers.

Pros:

Larger network of dentists

No need for referrals

Coverage for out-of-network services

Cons:

Higher premiums

Higher out-of-pocket costs for out-of-network care

Health Maintenance Organization (HMO) Plans

Overview: HMO plans require you to select a primary dentist and get referrals for specialists. They typically have lower premiums but less flexibility.

Pros:

Lower monthly premiums

Predictable costs

Comprehensive preventive care

Cons:

Limited provider network

Requires referrals for specialist care

Indemnity Plans

Overview: Also known as fee-for-service plans, these allow you to visit any dentist. You pay upfront and submit a claim for reimbursement.

Pros:

Freedom to choose any dentist

No network restrictions

Cons:

Higher out-of-pocket costs

More paperwork and claims to manage

Discount Dental Plans

Overview: While not insurance, these plans offer discounts on dental services for a monthly fee. Members pay the discounted rate at participating dentists.

Pros:

Immediate savings on services

No waiting periods or claims

Cons:

No insurance benefits for major procedures

Limited to participating dentists

Comparing Coverage Options

When comparing dental insurance plans, consider the following factors:

1. Preventive Care Coverage

Most plans cover preventive services like cleanings and check-ups at 100%. Look for plans that offer additional preventive services such as fluoride treatments and sealants.

2. Basic and Major Services

Check how much coverage is provided for basic services (fillings, extractions) and major services (crowns, root canals). Most plans will have a tiered structure, covering a percentage of these services after deductibles.

3. Annual Limits

Many dental plans have annual maximums, typically ranging from $1,000 to $2,000. Be sure to understand these limits to avoid unexpected expenses.

4. Waiting Periods

Some plans impose waiting periods for certain services, especially major treatments. If you need immediate care, look for plans with minimal or no waiting periods.

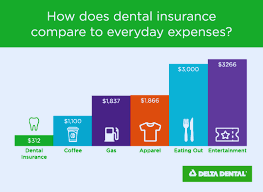

5. Premiums and Deductibles

Evaluate monthly premiums and deductibles to find a plan that fits your budget. Remember, the lowest premium may not always provide the best value in terms of coverage.

How to Choose the Right Plan

- Assess Your Dental Needs: Consider your family’s dental history, frequency of visits, and any anticipated treatments.

- Research Providers: Ensure your preferred dentist is in-network, especially for PPO and HMO plans.

- Read Reviews: Look at customer reviews and ratings for different insurance companies to gauge their service quality and claims process.

- Get Quotes: Contact multiple providers for quotes and compare coverage options to find the best fit.

Conclusion

Choosing the right dental insurance plan requires careful consideration of your dental needs, budget, and the specific coverage options available. By understanding the differences between PPO, HMO, indemnity, and discount plans, you can make an informed decision that benefits your oral health.

If you’re ready to explore your options, start by consulting with dental insurance providers today. A healthy smile is just a plan away!

This SEO-optimized blog post targets keywords like “Dental Insurance Plans Comparison,” “types of dental insurance,” and “choosing dental insurance,” making it valuable for those searching for guidance on this topic.